Benefits To Consolidating Leases

December 20, 2018 by Reece Tomlinson

For many growing businesses, the decision to lease new assets is an easy one. They need the assets for operations, their needs as a growing company can change dramatically in a short span of time and in the current, fast-paced, technological climate, purchasing new assets which may quickly become obsolete can be risky. On the financial side, leasing can improve liquidity, optimize working capital and save cash for strategic investments. As such, business leaders and decision makers often find themselves juggling multiple lease agreements with differing interest rates, payment dates, end terms, etc. Managing the different factors for every lease agreement can become a major issue if someone is not on top of it, and often the businesses who are unable to afford such supervision, are the ones with the most lease agreements. From experience, lease consolidation can have many benefits in these circumstances such as Better Terms, Manageable Cash Flow and Time Savings. Let us explore each benefit individually:

Better Terms

For any growing business, the financial situation they were in when they first signed their leases is not the same as a few years down the road. As such, they may now have more bargaining power when they come to the table and have a wider variety of lessors to chose from. Based on businesses we have consulted, when they consolidate, it can lead them to receive an improved effective interest rate, a longer term, etc. Ultimately, this may mean saving even more cash for daily operations or strategic investments.

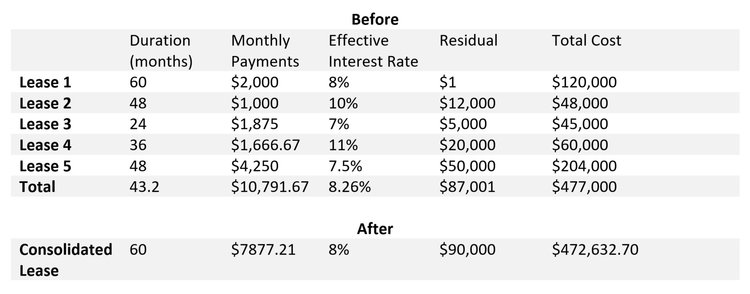

Below is a simple example with figurative numbers of how those terms may look:

As can be seen from the table above, by consolidating the leases it is possible to save on the total cost of all the assets by lowering the effective interest rate. One of the most important parts for any business though, is the monthly payments which are drastically lower than what was being paid before consolidating as often it is possible to increase the duration of the lease to lower the payments. Therefore, creating more working capital for the business.

Manageable Cash Flow

As the saying goes, “too much of a good thing can be a bad thing” and this holds true for having too many leases with different payment dates. If someone is not managing them properly, it can become a nightmare when payments are missed due to manual error or simply not having the cash available at the time. This can lead to paying unnecessary fees and interest, and even issues in the future getting new creditors. Consolidating leases can eliminate these issues by having only one payment date for all leased assets, leading to a more manageable cash flow.

For many businesses, even if they have not received the benefit of better terms when consolidating or end up paying more to consolidate due to their financial situation, it can be worth the cost to be able to better manage cash flow and save time.

Time Savings

Time is money and for business leaders that is especially true. At RWT Growth, we always hear leaders say they wish they had more time for the important things. That they feel like they are always fighting fires, but never have the time to sharpen their ax. Consolidating leases can save many hours of lease management allowing for more time to invest in what is important.

Conclusion

Having highlighted three ways, Better Terms, Manageable Cash Flow and Time Savings, that businesses can benefit from consolidating leases, it is important to keep in mind that every situation is different. Businesses may not always be able to attain all three benefits from consolidating, but sometimes only one of them is necessary to make it worthwhile.

Fuelling big growth

Custom capital solutions designed to grow your business to the next level. We help navigate the complexities of business when the stakes are high.